A company's profit margin is calculated by

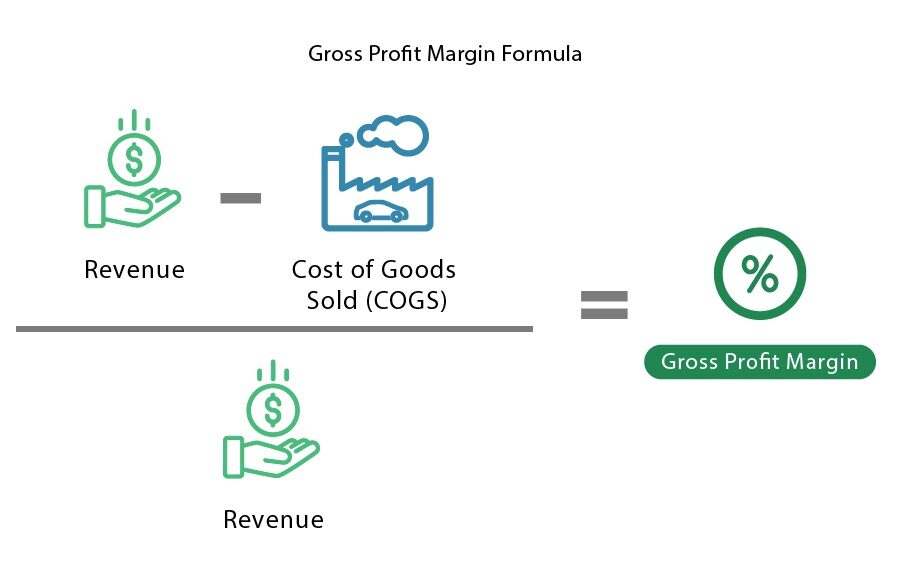

The formula of gross profit calculation is the following. It is calculated by taking sales and subtracting costs directly related to creating or providing the product or service such as raw materials and labor.

Profit Margin Formula And Ratio Calculator Excel Template

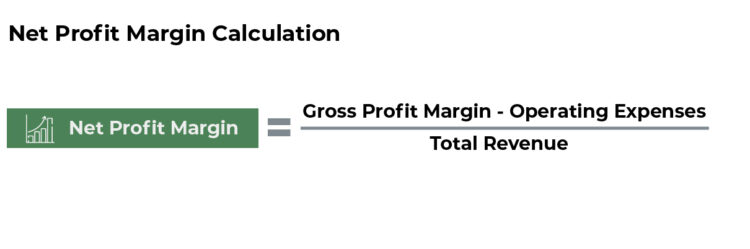

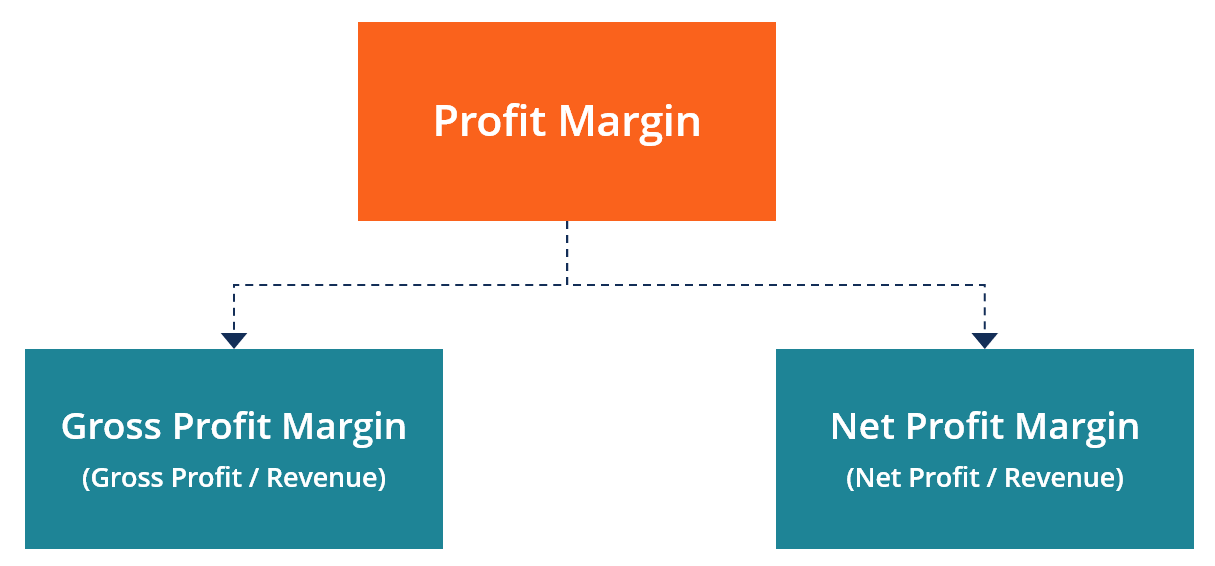

Profit margin refers to the percentage of profit made by a business and is calculated by dividing net income by revenue.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

. Enter the number of injuries leave. Net profit margin shows a companys profit after deducting all of its expenses including the cost of goods sold operating costs and interest payments and taxes. _______ cost is not paid by the insurance company and is unrecoverable.

The operating profit would be Gross profit Labour expenses General and Administration. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified. Select an injury type from the drop-down menu OR enter the total workers compensation costs.

Enter the profit margin leave blank to use default of 3. The net profit margin formula. Terms in this set 10 A companys profit margin is calculated by.

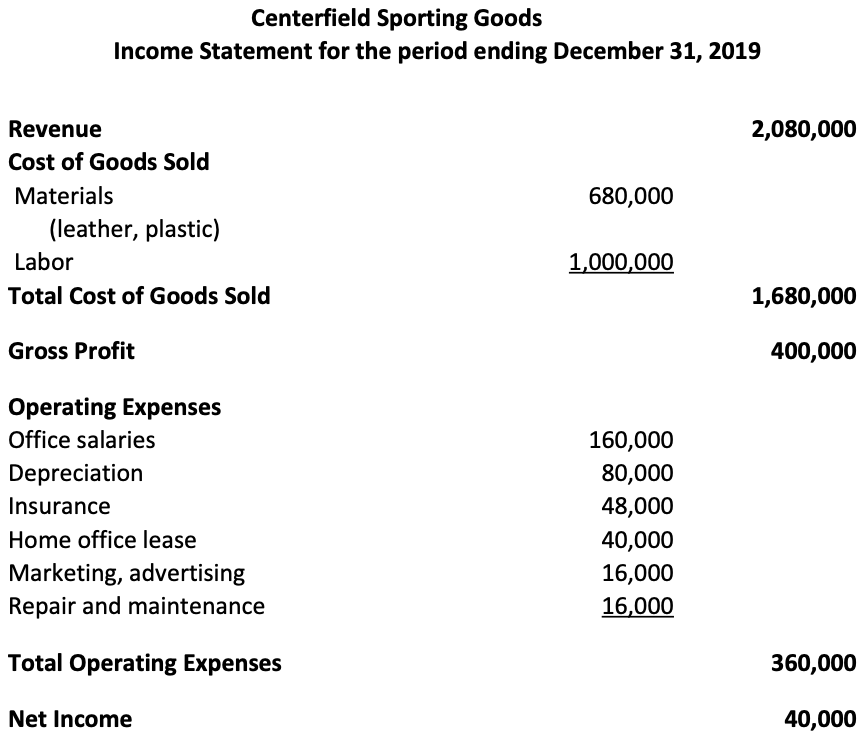

Net profit margin net profit total revenues. Over a decade of business plan writing experience spanning over 400 industries. A companys profit margin may be calculated by deducting its cost of goods sold COGS from.

This factors in everything from the cost of making the products or services operating expenses all the way. Calculate the net profit. There are three types of profit margin.

Following are the three main steps you should take to calculate the gross profit margin. Promo-body-link How to calculate net profit margin. Profit Margin Total Profits Total Sales.

According to KeyBanc Capital Markets the 2020 median subscription gross margin calculated as gross profit divided by total revenues is 80. 042 x 100 42 gross profit margin. The gross margin drops to.

The most common computation used by companies is the net profit margin NPM. This means that Company A currently has a gross profit margin of 42. Now we will deduct the operating expenses from gross profit to determine the operating profit.

You find this by following this formula. The net profit margin is determined by dividing net profit by total revenues in the following way. There are two steps to determining a companys net profit margin.

Net profit revenue - COGS depreciation. Calculate the gross profit.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Gross Profit Margin Formula Definition Investinganswers

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

What Is The Gross Profit Margin Bdc Ca

/dotdash_Final_Profit_Margin_Aug_2020-01-853bda68168747d89807dc6ad1053843.jpg)

Profit Margin

Net Profit Margin Formula Definition Investinganswers

How To Determine Profit Margin For Your Small Business 3 Steps

Net Profit Margin Calculator Bdc Ca

What Is Gross Margin And How To Calculate It Article

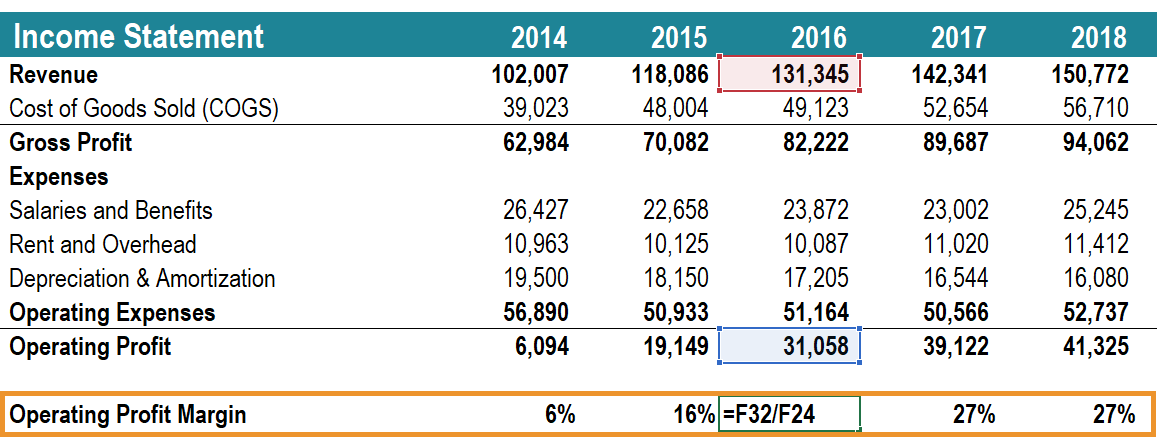

Operating Profit Margin Learn To Calculate Operating Profit Margin

Gross Profit Margin Formula Definition Investinganswers

Gross Profit Margin Formula Meaning Example And Interpretation

Profit Margin Guide Examples How To Calculate Profit Margins

Gross Profit Margin Formula And Calculator Excel Template

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Net Profit Margin Calculator Bdc Ca