Straight line method formula

Cost is the initial cost of the asset at the start of period 1. Therefore an equal amount of depreciation is charged every year throughout the useful life.

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

The accumulated depreciation will be 30000 for year one and you will add to the total every year.

. The formula reads AmortizationInterest Payments Bond Amount with Interest -. Therefore the straight line method formula has been penned in accordance with the contributing factors of the method. The formula for the straight-line depreciation method is quite straightforward to calculate.

The closing book value will be your opening value. Determine the cost of the asset. Depreciation Per Annum Cost of Asset Salvage Cost Depreciation Rate or.

The straight-line method of depreciation posts the same dollar amount of depreciation each year. The formula for calculating depreciation under the straight-line. The straight line basis is a method used to determine an assets rate of reduction in value over its useful lifespan.

Cost of Asset is. According to the Straight line method the cost of the asset is written off equally during its useful life. Salvage is the final value of the asset at the.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total. Other common methods used to calculate depreciation. The formula is hence derived by the difference between the salvage.

Where Book value of. 35000 300010 years 3200. Straight line depreciation cost of the asset estimated salvage value estimated useful life of an asset.

Depreciation Value of Asset Salvage Value Life of Asset. Depreciation Expense Cost Salvage ValueUseful life. The more elaborated explanation of the point-slope method of the equation of a line is the two-point method of a line equation.

This method evens out the profits and expenses at an equal rate using the straight-line depreciation method. The Eastern Company will allocate a. You will get 30000.

Formula for calculating Straight line depreciation method is as under. To determine straight-line depreciation for the MacBook you have to calculate the following. The straight-line depreciation formula.

The straight line calculation steps are. The straight-line amortization formula applied to bonds requires little more than basic math. Purchase price and other costs that are necessary to bring assets to be ready to use.

The formula first subtracts the cost. Formula for Straight Line Depreciation Method. Eqstraight line depreciation rate frac annual depreciation expense cost of item - residual value of.

Annual depreciation 2000 - 500 5 years 300. To apply the straight-line method a firm spreads the cost of the asset out across the assets useful life at a steady rate. The formula for calculating straight line depreciation is.

Calculate annual depreciation expense of this asset using straight line method. Straight-line depreciation method can be calculated using the following formula. Book value residual value X depreciation rate.

The formula to calculate the straight-line depreciation rate is. To calculate depreciation through this method first you need the SYD and you can find this out by adding the digits in the assets lifespan. The formula used in calculating straight-line depreciation is.

One downside of using the straight-line depreciation. For example a machine has a lifespan. Straight line equation using two-point forms.

Youtube Method Class Explained

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

Depreciation Bookkeeping Business Accounting Education Accounting Basics

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Equations Of Straight Lines Linear Functions Math For Kids Math Lessons Fun Math

Linear Regression Vs Logistic Regression Data Science Data Science Learning Data Science Statistics

Illustrates How The Slope Formula Is Used To Find The Slope Of The Line Passing Through A Given Two Points Or Ordered Slope Formula Studying Math Math Lessons

Journal Entry For Depreciation Accounting Notes Accounting Principles Journal Entries

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Depreciation Of Fixed Assets In Your Accounts Marketing Process Accounting Small Business Office

Accelerated Depreciation Method Accounting And Finance Accounting Basics Accounting Education

Profitability Index Pi Or Benefit Cost Ratio Money Concepts Investing Budgeting

Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Family Money Advertising Costs

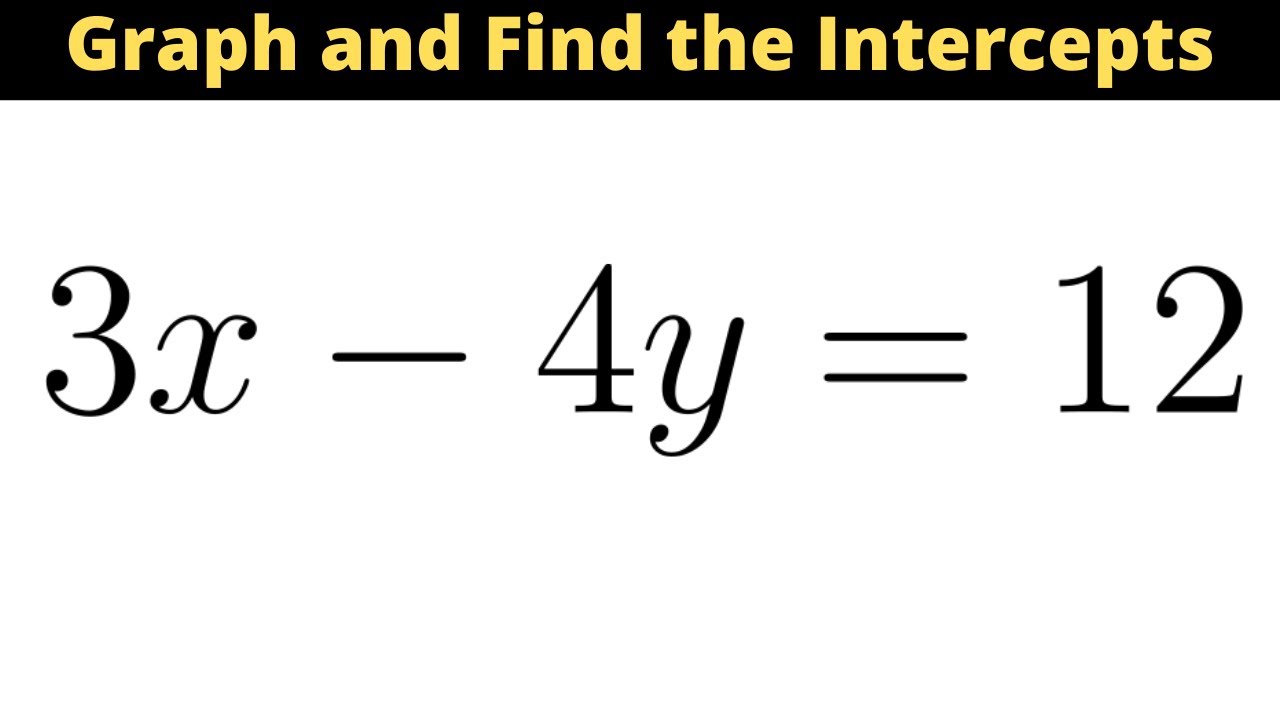

Graph The Equation Of The Line 3x 4y 12 And Find The X And Y Intercepts Graphing Math Videos Equation